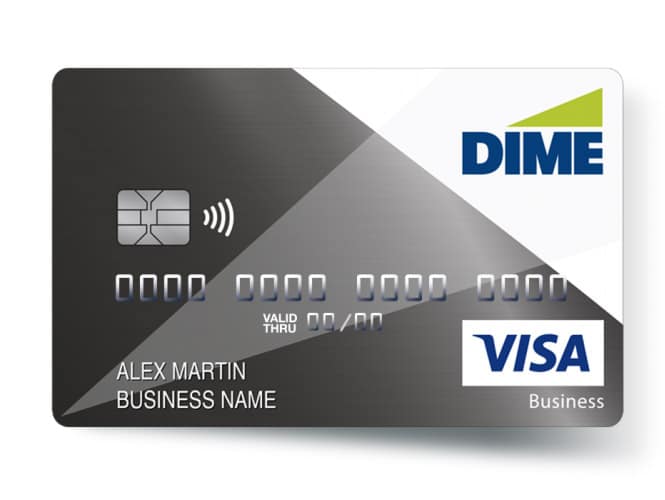

business credit cards

Dime has the right card for your business.

Choose from our popular business credit card¹ options such as low rate, cash back or flexible rewards.

No matter which card you choose, your business will benefit from important features like:

- Free online expense reporting tools.

- No fee for additional employee cards.

- Mobile payment capability for added convenience.

- Zero Fraud Liability.² You won’t be liable for fraudulent purchases when your card is lost or stolen.

- Cardmember Service available 24 hours a day/365 days per year.

Cardmember Online Account Access

If you currently have a Dime credit card account, you can easily access your account by logging in. Once logged in, view current balances, pay bills, set up auto-pay, or sign up for account alerts.

Explore additional business banking solutions.

Experience the benefits of a truly comprehensive service tailored to your specific business needs.

Business

Advantage

Statements

Savings

You deserve a business savings account that works just as hard as you do.

Learn MoreDownload Business Credit Cards Brochure

You can download a brochure version (PDF) of this page and its subpages by clicking the button below.

¹ Subject to approval. The creditor and issuer of these cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc.

² Elan Financial Services provides zero fraud liability for unauthorized transactions. Cardholder must notify Elan Financial Services promptly of any unauthorized use. Certain conditions and limitations may apply.