QUICK START

Welcome to

Business Online Banking

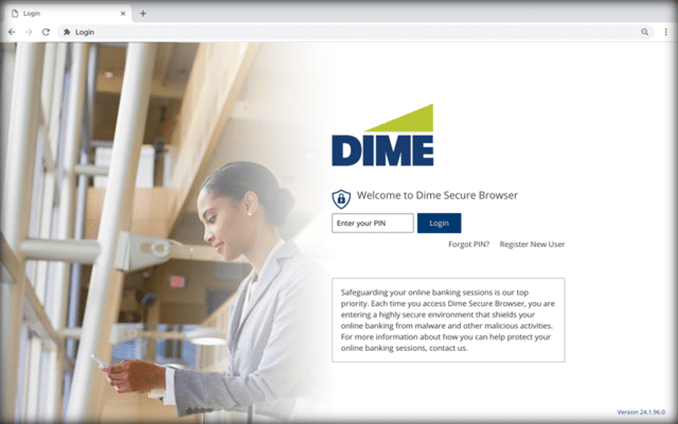

Please follow the instructions provided in the welcome email. You will be required to use either the Dime Business Mobile-Token or the Dime Secure Browser. An activation key has been provided to you to complete the setup of your business online banking profile.

App Downloads

To access the Business Mobile App, you will first need to access the Activation Key located in Business Online Banking or Business Online Banking PLUS. You must have administration rights to access the Activation Key:

Business Online Banking App Activation Key

1. Click on your name in the top right of the screen.

2. Select Edit My Profile.

3. Scroll to the Software Activation Key.

(If the key has expired, click Reset to view

Business Online Banking PLUS App Activation Key

1. Go to My Settings.

2. Select My Profile.

3. Scroll to the Software Activation Key.

(If the key has expired, click Reset to view an active key.)

¹ Must have Dime Online Banking for Business to use Dime Business Mobile Banking. The Dime Business Mobile Banking App is available for select mobile devices. Dime Business Mobile Banking is a free service from Dime. However, your mobile carrier may charge for data and text message usage.

Dime Secure Browser Installation Instructions – Click Here

Sign In to Business Online Banking

Business Online Banking

Business Online Banking PLUS

Video Tutorials

Reference Guides

- Business Agreement for e-Statements

- Business Online Banking Guide

- Business Online Banking PLUS Guide

- Business Online Banking PLUS User Maintenance Guide

- Business Online Banking PLUS Payment Maintenance Guide

- Dime Business Mobile-Token Install

- Quickbooks Desktop Direct Connect Guide

- Remote Deposit Capture Guide

- Secure Browser Install for MAC

- Secure Browser Install for PC

Contact Us

If you have any questions or need assistance with using our Business Online Banking, our Treasury Management Support Team is available to assist you.

You can reach them by phone, email or through online secure messaging during normal business hours.

Treasury Management Support:

631-723-7620 or [email protected]

Frequently Asked Questions

What is Business Online Banking and Business Online Banking PLUS?

Business Online Banking is our small business platform that will allow you to make internal transfers, mobile deposits, and bill payments. Business Online Banking PLUS is our corporate platform that will allow you to make wire transfers, ACH transfers, Remote Deposits and access other additional Treasury Management Products.

How do I enroll in Business Online Banking or Business Online Banking PLUS?

Complete the attached form and submit to your banker or email to [email protected].

How frequently is my account information updated?

Transactions on your accounts are processed in real time.

How much past history is available to see?

24 months of history is available.

How many months of statements are available online?

24 months of statements are available.

Can I transfer funds to another institution?

To transfer funds to another institution, you will need Business Online Banking PLUS. To enroll fill out the attached form and submit to your banker or email to [email protected]. If you have Business Online Banking and would like to upgrade to PLUS, please contact your banker or local branch. Wire and ACH origination is available only on the PLUS platform.

Can I pay my employees with business online banking?

To pay your employees, you will need Business Online Banking PLUS. o enroll fill out the attached form and submit to your banker or email to [email protected]. If you have Business Online Banking and would like to upgrade to PLUS, please contact your banker or local branch. ACH origination is available only on the PLUS platform.

Can I wire money to another institution?

To wire money to another institution, you will need Business Online Banking PLUS. To enroll fill out the attached form and submit to your banker or email to [email protected]. If you have Business Online Banking and would like to upgrade to PLUS, please contact your banker or local branch. Wire origination is available only on the PLUS platform.

Do I have to be enrolled in Business Online Banking to use the mobile app?

Yes you must login to either Business Online Banking or Business Online Banking PLUS prior to logging into the Dime Business Mobile App. You will need to obtain an Activation Code located in the browser-based platforms.

Can I make a mobile deposit with business online banking?

Yes, you can complete mobile deposit with the Dime Business Mobile app. You will first need to login to either Business Online Banking or Business Online Banking PLUS to obtain the activation code to setup you mobile app. Once logged into the mobile app, mobile deposit is available to you.

What are the limits for mobile deposit for a business?

All business customers are allowed the basic limits of $3000 per item/$10,000 total daily limits. Higher limits may be obtained by speaking with your banker or local branch.

How do I find the mobile app for business online banking?

How late in the evening can I make a transfer for the funds to be processed the same day?

All internal transfers made in Business Online Banking or Business Online Banking PLUS are effective immediately.

How late in the evening can I make a remote or mobile deposit to be processed the same day?

Mobile Deposit and Remote Deposit transactions must be submitted prior to 7pm to qualify for same day.

Do I need to sign up separately for the bill payment services?

If you would like Business Bill Payment, you may select it on the enrollment form to be added. If you are an existing online user, a request to add can be made to your banker or local branch.

Can I set up automatic bill payments?

Yes, recurring and scheduled automatic payments can be processed in Business Online Bill Payment.

Can I include invoice details with my payments?

Yes, you may include invoice details with your payments through Business Online Bill Payment.

Do my bills get paid electronically or with a paper check?

Some individuals or companies can’t accept electronic payments, so we mail them a check through the U.S. Postal Service. For that reason, it’s important that you provide correct name and address information for all of your payees. If your payment is made by paper check, you’ll find the date the check was cashed on the Payment Activity screen in Bill Pay.